Summary: Present below is our approach and pitch deck for a startup that we (me and cofounder) had planned to launch in Live Commerce space. It covers the opportunity, current pain points of sellers, the scale of the market, and why we ultimately decided not to pursue it. This is the result of first and second-hand research that we conducted during the summer of 2021.

Please read the blog on Live Commerce to know more about the space.

Summary : Why & What We Want To Do

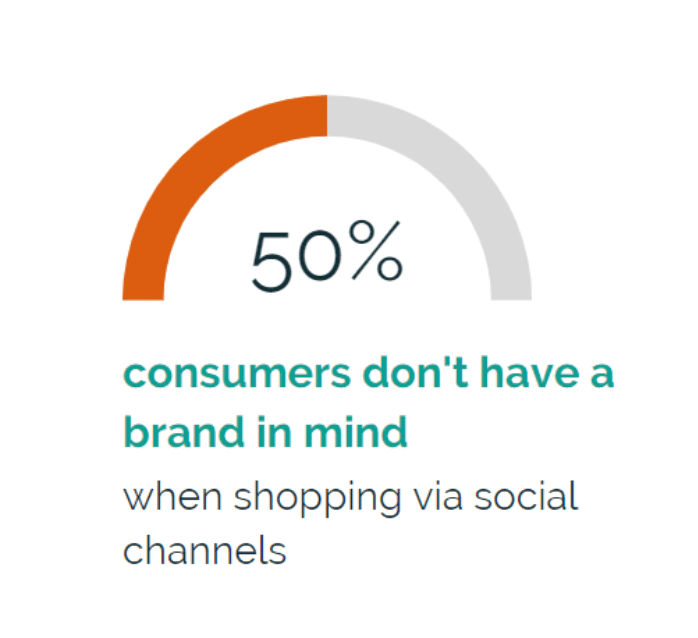

- Indian shoppers love in person interaction & engagement and have time for it (we are time rich).

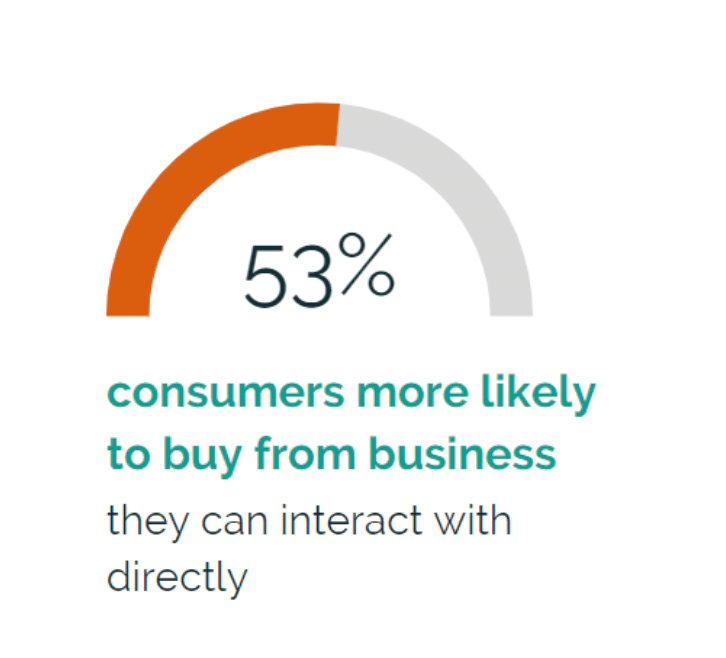

- Indian sellers have a superpower: they can express themselves, make consumers feel special, build trust, and convert it into sales.

- Ecommerce 1.0 prevented sellers & consumers from leveraging the true power of internet → forming connections easily and increasing reach & business.

- We want to change that & build a platform which maximises these desires & superpowers.

Our goal is to create a SaaS-enabled live social marketplace that connects sellers with their communities, enabling commerce in the most immersive and natural form possible online.

Problem Statement

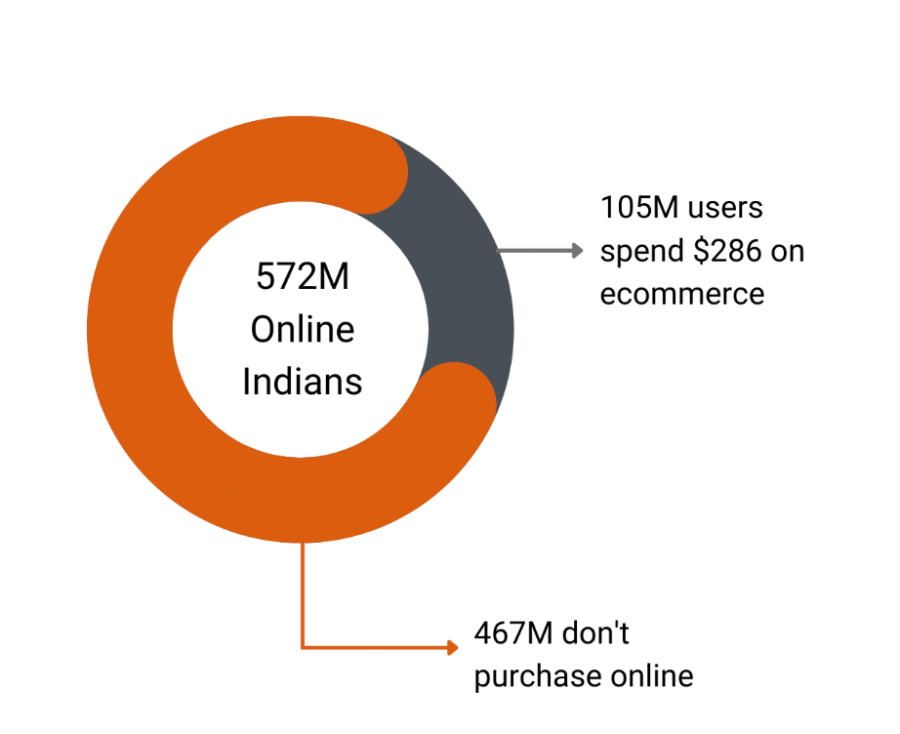

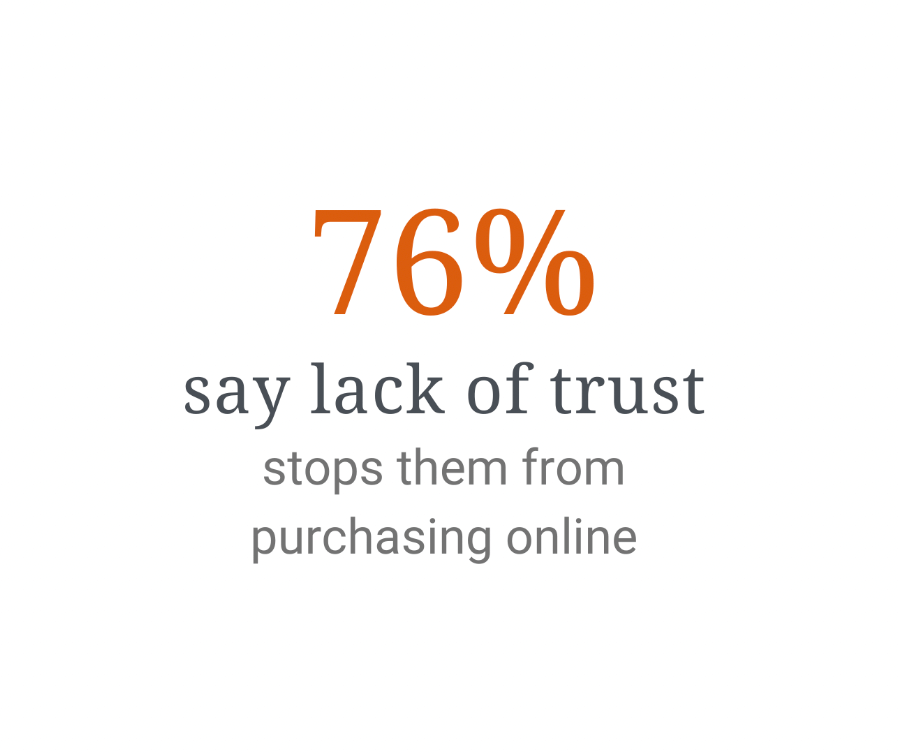

Ecommerce 1.0 lacks trust

Offline: Trust & Personalised Experience Solved Intimately

Mass Economy Segment

| InShop Personal Attention & Advise |

| Touch & Feel |

| Local Language & Friendly Faces |

| Personalised offerings/Discounts |

Premium/Lux Segment

| Valet Parking or Golf Cart service |

| Free Wifi/Drinks |

| Product Reserved Service |

| Express/Easy Billing |

| Post Sales Support |

Online: Personal Interaction Solves Trust

Enter Facebook Live

Clip Breakdown

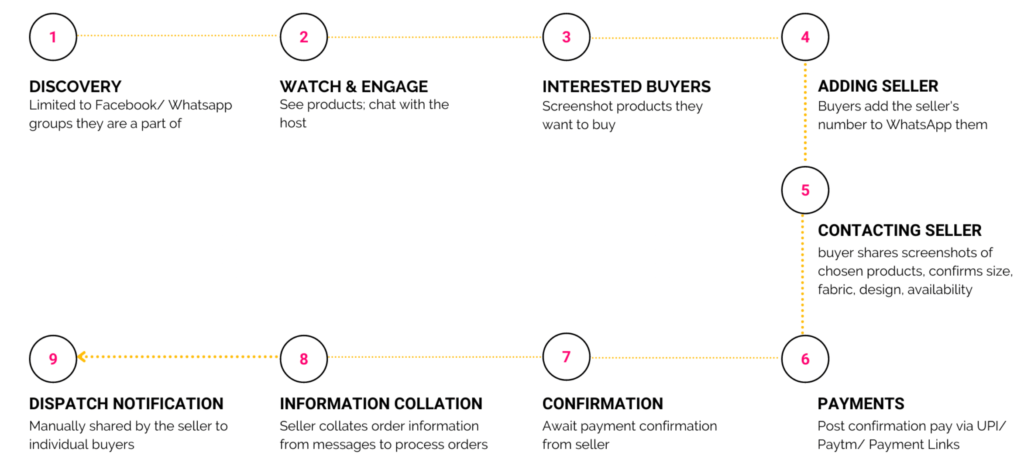

Facebook Live Journey Is Extremely Fragmented

FB Live Sellers Happy With Sales But Order Management is Big Pain

Dislike Filpkart/Amazon/Myntra

- Unhappy on existing marketplaces due to high commission 25%-40% and working capital + return issues.

- Tedious & expensive cataloging process for which they have invest over and above commission and this is a recurring expense.

- D2C brands have lack of trust on influencers and general belief is they are good for impressions but don’t lead to sale. (Influencers feel same as data is not openly shared most times).

Very Happy With Live

- Most sellers do alternate or daily shows and SKUs range from 800-8000 INR and get 30 – 200 orders/show.

- Low production cost and no tedious cataloging. They interact in Hindi or regional languages and very authentic feel to the show by answering viewer questions in detail.

- Engage with free gifts to sharers/buyers & chit based lucky draw. All this done manually to keep excitement high.

Order Management a Big Hassle

- Managing orders through multiple WhatsApp numbers and employees. Tracking live inventory is a challenge when scaling up.

- Lack of a customer support system results in significant time spent answering queries related to order tracking, size mismatches, and more.

- Manual payment reconciliation leads to mistakes and a poor viewer/buyer experience.

- D2C brands treat Facebook Live as a tier 2 platform & have had litle success on Insta due to broken experience.

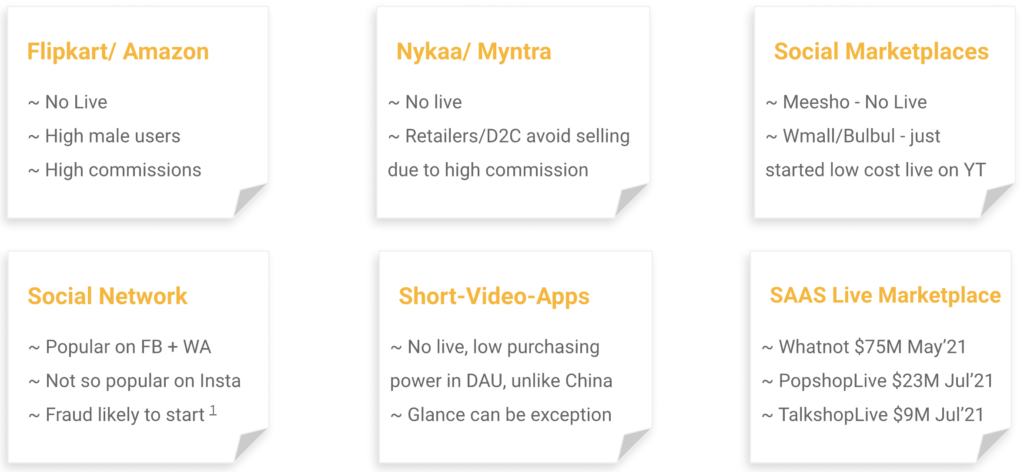

Current Landscape

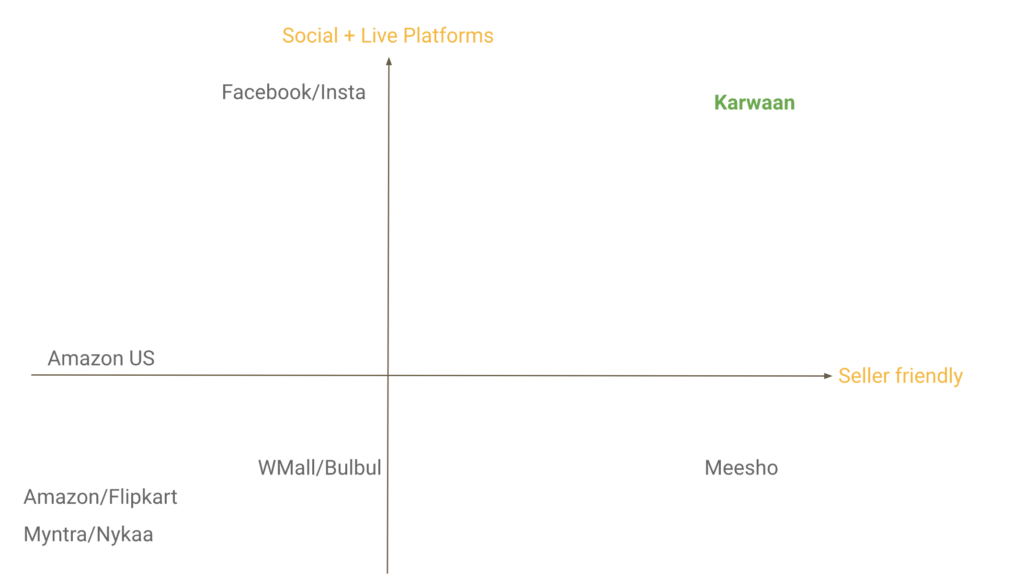

No Marketplace for seamless Interactive Live Commerce

Possible Gap In The Market

In India, no platform enables seamless social live interaction & purchase between sellers & consumers

Karwaan

A Saas led Live Social Marketplace For Shopping & Entertainment

Live

Integration

- Shoppable Live streams

- Gamification & Rewards

- Integrated AR/rich features

- Training & upskilling

Social

Engagement

- Seller social Accounts

- Seller/Consumer chat

- Community nurturing/CRM

- Influencer & KOC platform

Interactive

Marketplace

- Live order management

- A/V catalogues/reviews

- Payment + 3PL integration

- Shopify/Insta++ integration

Online mall with countless full screen live streams enabling shopping/entertainment in a social way all in one app

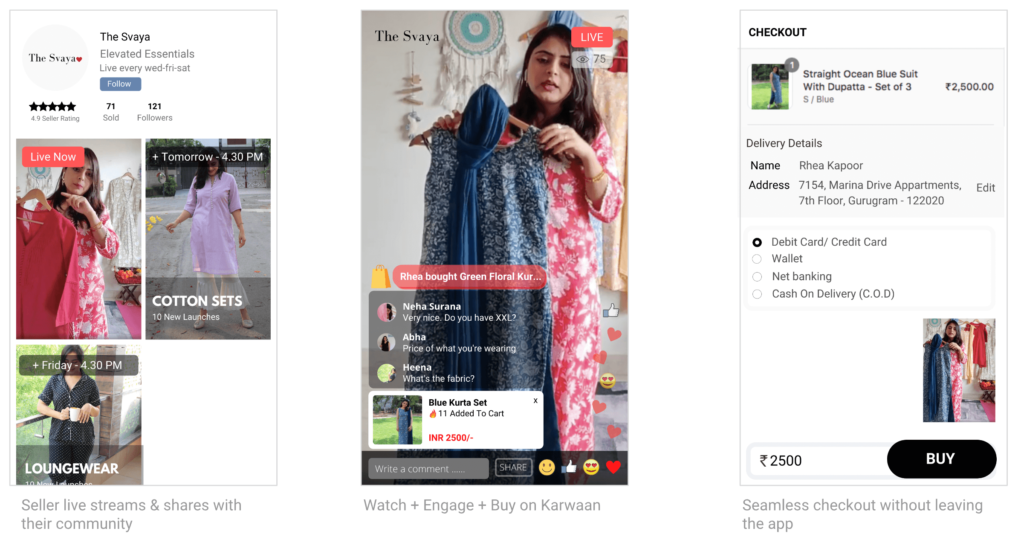

Representative UX on App

Case Study: The Svaya

- TheSvaya is a fusion wear private digital only brand with just 2,500 likes on FB

- Tried first FB live in June. Got 1 viewer and no sale.

- Tried 2nd FB live by sharing with Friends/Family & FB group → 14 concurrent viewers, 100 views and 9 orders.

- Building team now to leverage this medium constantly

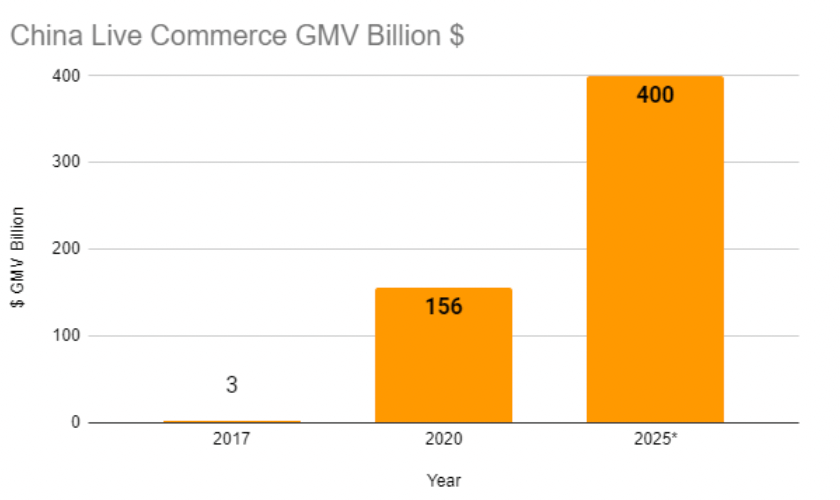

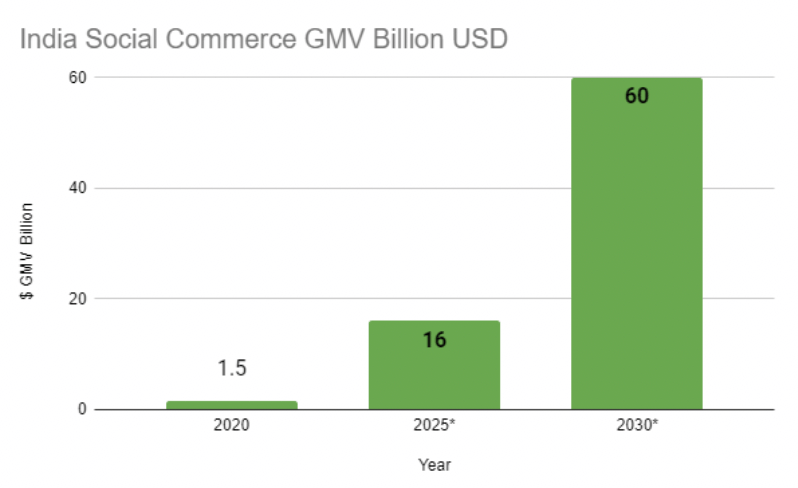

Live Huge Success in China & India Trend Catching On

Live is not a feature, it’s the future!

FAQ

Will China model come as in India? No

4x Spending Power of India

– ShortVideoApps ventured into commerce to increase revenue (not start it).1

– Tips & Ad revenue not much in India.

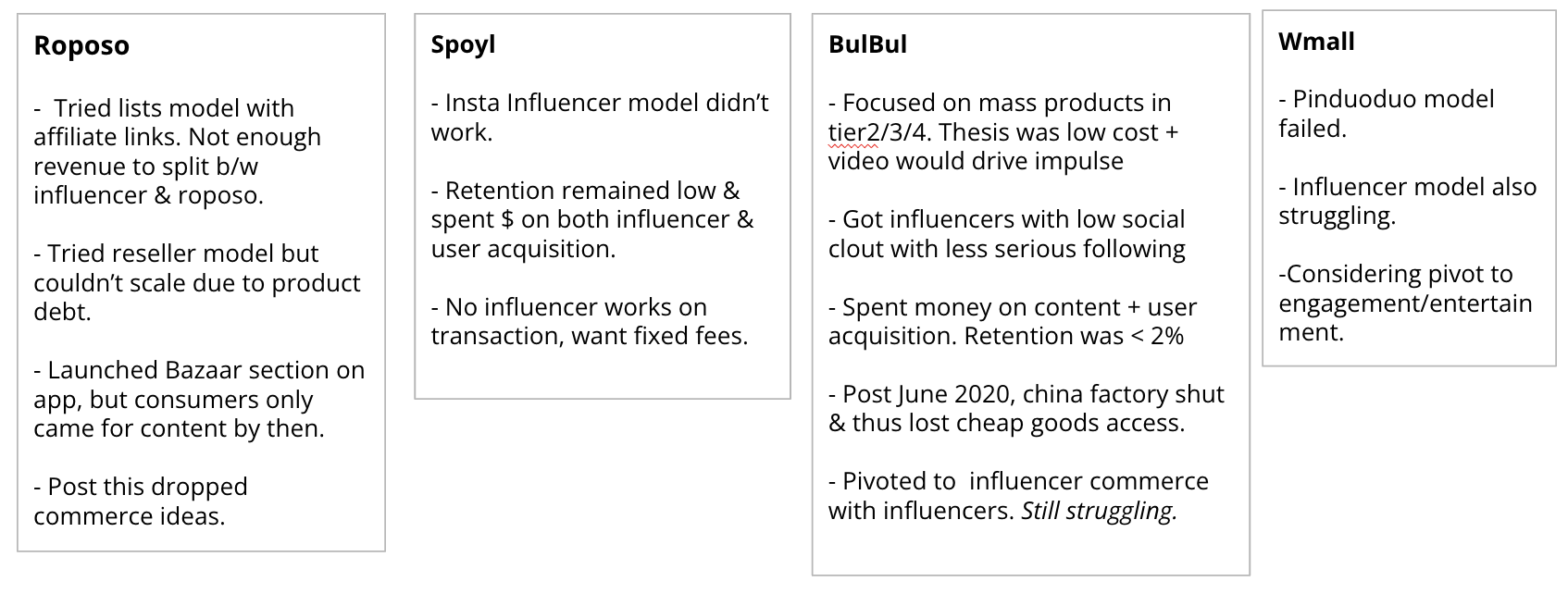

Why will you succeed when others have failed?

Live Interaction

Increases Retention

– Live interactions gives high retention.1 2 3

– FB sellers report ~ 25-30% D30 retention.

– Missing in Short Video Shopping Apps (SVSA), thus low retention.

Content Creation at Low Cost

– Production cost down by ~70% + live produces authentic content.

– Novelty missing in SVSA & Catalogue creation is expensive for sellers.

What about past landscape?

What About Flipkart/Amazon++?

Focus & Differentiate

Social & Live Marketplace

– FK/AZ/Myntra++ intent buying + complex product + heavily branded.

– We strongly focus on Live & Social first product focusing on authenticity.

Tiered

commissions

– Low transaction fees + large untapped seller base for quick growth.

– 0% commission for sellers own customers + x% for new customers.

Differentiate & Go Regional

– Focus on unbranded ethnic wear, accessories, kids, organic & Beauty segments.

– Target local and regional viewers & influencers to grow dedicated following.

What About Moj/Takatak++?

Not A concern for now

High DAU but Low paying power

– Short Video Apps (SVA) no/low paying user.

– DAU/MAU game more important for them than commerce.

Social & Live Marketplace

– Excite & Engage user with diverse merchandise & streamer personality.

– Leverage other social media (unlike all SVA) to increase content reach & engagement.

Focus on Community & Trust

– Target local and regional viewers & influencers to grow dedicated following.

– Social marketplace with high trust to be one of the moats for high retention.

Thanks. That’s all for now, come join us as we go Live

Why we didn’t pursue and go Down the live commerce rabbit hole?

- There were three ways to enter this space: Saas only, Saas + Marketplace (like WhatNot), or pure Marketplace. However, the chances of success were very low for any of these approaches.

- Saas has not had much success traditionally, and we felt the same would happen here.

- The marketplace approach meant we would have to spend on creating distribution, and the costs didn’t add up.

- The best approach was Saas + Marketplace. However, throughout our seller interviews, there was never any appreciation for Saas to help solve their problems. They were only excited about more demand.

- Prospects of bringing their viewers from Facebook to another platform were not received warmly. While modern-age D2C brands were fine with it, the bulk of sellers were averse to sharing their audience.

- Ultimately, we felt that live is just a channel, and commerce via live makes more sense on platforms that have existing distribution.

Based on the above factors, we decided it was best not to pursue this further. In hindsight, we made the right decision.

Nonetheless, I’d be happy to chat with you and hear your views. Please reach out to me here.